In my current magazine story I cite the ongoing studies by the Kauffman Foundation, based in Kansas City, on the conditions that encourage or discourage the creation of new, entrepreneurial businesses around the country. One reason for Kauffman’s emphasis, as I point out, is the startling-but-true observation that virtually all the net job creation in the U.S. economy comes from brand new companies, in their first few years of existence. As Dane Stangler of Kauffman says in the foundation’s latest report:

In any given year, new and young businesses create nearly all net new jobs in the U.S. economy. Put more starkly: if you want new jobs, then you want new and young firms. Older, established companies tend, on balance, to be net destroyers of jobs.

That is: big, established firms, from WalMart to IBM, employ a lot of people, but overall more of them are shedding rather than adding employees. Newly created firms, whose payrolls by definition represent jobs that weren’t there before, are in toto the source of virtually all nationwide employment growth.

Stangler’s comments were part of a big, book length new report from Kauffman on the prospects for U.S. entrepreneurialism. Overall the findings were positive: the report’s title is The Looming Entrepreneurial Boom, and this from an organization known for cautionary messages about business prospects.

Again from Stangler’s introduction:

Despite [all the obvious U.S. economic problems], rumors of the death or disappearance of American entrepreneurship may be exaggerated. … Billions of dollars now flow through crowdfunding and marketplace lending sites, and equity crowdfunding is now permitted for non-accredited investors in the United States.

Entrepreneurship is infiltrating large portions of the U.S. economy, even in industries that do not typically see significant new business activity. Ask a banker whether she thinks we’re in an entrepreneurial slowdown, and she’ll point to the hordes of “fin tech” (financial technology) startups that are picking off bits and pieces of traditional banking. Talk to folks in the automobile industry—usually associated with the opposite of entrepreneurship—and you’ll hear about the dozens of VC-backed “auto-tech” startups. Check out the “periodic tables” compiled by CB Insights in areas like insurance, payments, e-commerce, digital health, and more, and it becomes hard to avoid the conclusion that the United States is enjoying a veritable entrepreneurial revolution….

Inevitably, the high tide of startup financing will recede—and high-profile valuation write-downs may be the beginning—but there are some indications that this most recent tech startup boom will have permanent economic benefit. For one thing, the costs of starting a tech company and experimenting with different ideas have come down dramatically. The causes of this cost reduction—cloud computing, server access, etc.—will not go away. For another thing, there is evidence that “hot market” entrepreneurial financing can, in the long run, generate more radical innovations. And, in the more traditional “small business” sector, there are some indications that lending conditions (finally) improved in 2015 after a slow recovery from the recession.

This is obviously in keeping with the message Deb and I have been presenting: that more creative and opportunity-seizing actions are underway, in more of the country, than our standard “America is going to hell” / “we don’t win any more” political and media tone represents. The strains, failures, and inequalities of this Second Gilded Age are intense — and well known. Fewer people are aware of the way organizations and communities are beginning to respond.

I won’t try to summarize the whole report, which is very ambitious in its range and features a large number of individual authors, some of whom challenge the predictions or analyses of others. It’s worth reviewing at length, at this site.

***

Two additional points. To me the most interesting section of the Kauffman report is one that offers imagined future-histories. William Kerr, of the Harvard Business School, has predictions about both the creative and the destructive potential of endless technological innovation. Then Bowman Cutter, now of the Roosevelt Institute (and a friend of mine from the Carter administration), presents something in the spirit of Edward Bellamy’s classic Looking Backward: 2000-1887. Bellamy’s book, published in 1888, was an imagined history of how society found its way toward a utopian future. Cutter’s is a look back from the dramatically improved U.S. economy of an imagined 2040:

Looking back, the years between 2020 and 2040 turned out to be the best twenty-year period of U.S. economic performance since the 1950-1970 miracle years….

These past 20 years, however, were not even remotely a rebirth of the old economy. The 1950s did not just come back. Instead, as a result of big changes that no one predicted, but which seem inevitable now, the economy very rapidly evolved.

Much about how Americans work and take care of themselves changed substantially. A higher proportion of the economy was composed of smaller and more specialized firms. Many jobs were automated. New, more flexible (and less secure) work options have taken their place. "Work" did not disappear, but the "job" — stable long-term employment with one firm — fell as a percentage of all work. As a result, Americans have found themselves more responsible for managing exigencies, like health insurance and retirement planning, which were once handled by employers.

All of these changes involved immense and difficult adjustments, but they did not mean economic disaster. Ordinary women and men were better off than all the trends suggested twenty-five years ago.

What happened?

And he goes on to give his answer of a desirable — and, he argues, possible — path forward. It is based on 10 positive surprises, of which the most fantastical, for the moment, is #8: “The National Political system began slowly to work again.” Very much worth reading.

***

When reading the Kauffman report, I also thought of “Civic Jazz in the New Maker Cities.” This is an essay by Peter Hirschberg, a longtime tech executive who now directs the Maker CityInitiative and who has become a friend as our worked has intersected. At the Techonomy Detroit conference last fall, he gave a talk that was essentially the liberal-arts version of the change that the Kauffman report is describing in business/economic terms. For instance:

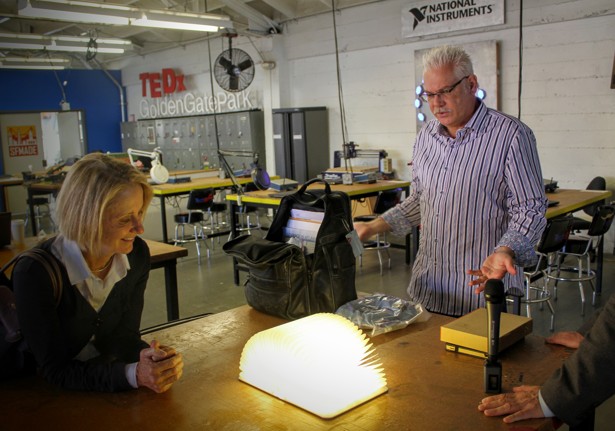

The name I like for this movement is The Maker City… It captures this notion that our cities are laboratories for economic development, entrepreneurship, and cultural development. They are platforms for experimentation and protoyping ideas. Maker City reflects the emergence of the maker movement and its characteristic “can-do” attitude. It reflects a set of changes that will impact education, economic development, and civic engagement. It could be an important force in re-defining the future of manufacturing in the United States, bringing back local production….

At the White House makers faire last year 100 cities took a pledge to invest in maker spaces, urban manufacturing, maker and project based education, among other goals. Pittsburgh discovered it already had over 200 maker spaces and more than 2000 professionals engaged in making, project-based education or maker manufacturing.By networking these groups together, sharing what works, and learning how to leverage one another they’ve consciously been able to redirect education, economic development and manufacturing towards a more inclusive future.

Today that White House project has evolved into a formal maker city network. With funding from the Kauffman Foundation we are researching, documenting and working to scale the learning in Pittsburgh, Brooklyn, San Francisco, Macon, Detroit and a hundred other U.S. cities and towns.

It’s the genius of America that when we don’t know what the answer is, we experiment in hundreds of ways and endless places. Once, the frontier meant moving west. Today it is this contemporary form of rediscovery and reinvention... Tocqueville saw what we now call social capital at work in 1835 inDemocracy in America when he wrote about American’s need to associate, saying “Association is the mother of all science.”…

America is replete with experimentation and urgent curiosity. A movement is growing in our cities. It is built on the essential American genius of federation, experimentation, practicality, entrepreneurism, and innovation.

I mention in the current article that I changed my mind about two things. One is the city of Fresno. The other is the practical value of “the arts.” (Read the article for the back story.)

Actually there is a third: It’s about the “Maker Movement,” and whether it represents something real. When I wrote my article “Mr. China Comes to America” three-plus years ago, I wasn’t sure that the idea of dispersed, small-scale, high-value, rapid-cycle-time manufacturing in the United States was a real trend or just a fad. I’ve moved into the “real trend” category — for reasons suggested by the material I’m mentioning here, and others I’ll describe in coming days. Including a report later this week from the well-known FirstBuild manufacturing center in Louisville.